Almost a year ago we attended the blackest session in the history of the Spanish markets, where its selective reference, the IBEX35 , I got to drop 13% in a single session . That moment was key to start thinking about when to make purchases. If you were bought you should have put a STOP in the average of 200 and have left when it lost the 8,500. I, who had almost everything in a continuum value, never imagined that what happened with the coronavirus was going to affect all values, whether or not they had to do with travel or construction. It was more like energy but when a big hit comes, everything goes down. They would go down to the pharmaceutical companies that were later the star values of last year.

Many discarded the recovery in V, and now they jump that if in K and I do not know what more stories. What is clear is that the V has been in all markets, I already warned about it and said that we would see the 8000 next year and we saw them, in fact I said to collect the 8000 before the summer and then fall and it happened . As you can see in the last graphic of this link that I already published in April.

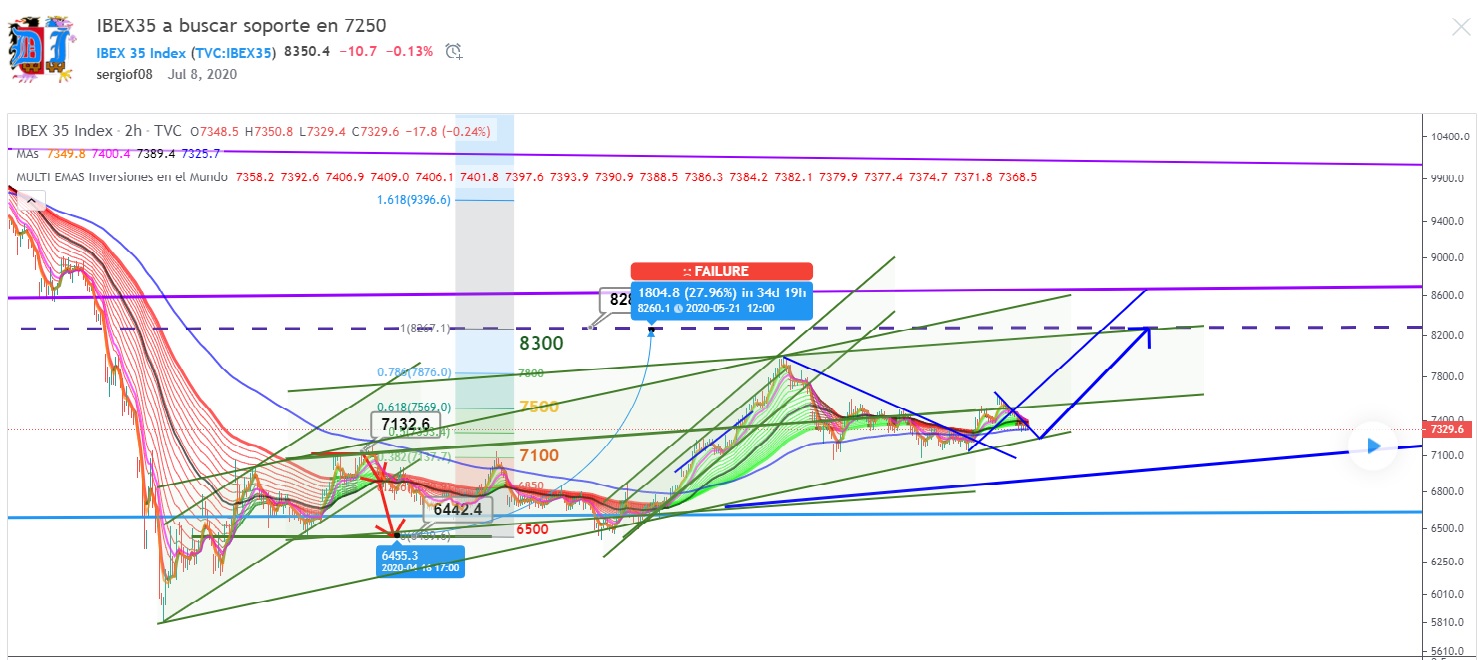

Then after correcting in July and reaching 7000 points, I expected it to break up as seen in these two July and August charts.

What I did not imagine is that after reaching the end of the triangulations due to how the coronavirus was in Spain, we would see the 6,400 again and in many values the minimum of March. Which did not happen in almost any other index in the world.

It was clear that things were not adjusting to the market and little by little things would change. If you had some liquidity it was time to put all the meat on the grill. TELEFONICA AT LESS THAN 3 EUROS, REPSOL AT 5 EUROS, SANTANDER AT 1.5 EUROS, BBVA AT 2 EUROS . These prices will never be seen again on these Spanish bluechips. Many said they were worth nothing, or that everything was bankrupt. But nothing could be further from the truth, very little volume was being traded down and everything that was sold was bought.

And the day came ...

Then a good November day would come and suddenly it would rise almost 9% in 1 hour, going up more than 1000 points, from 6700 to 7700 when crossing averages and leaving a pennant the day before. Some madman from some forum that was short would be stunned and if it were leveraged already with little chance of recovering. Even if it doubled its position right now at 8400 I highly doubt it has continued. And all this without still holding the elections in the USA.

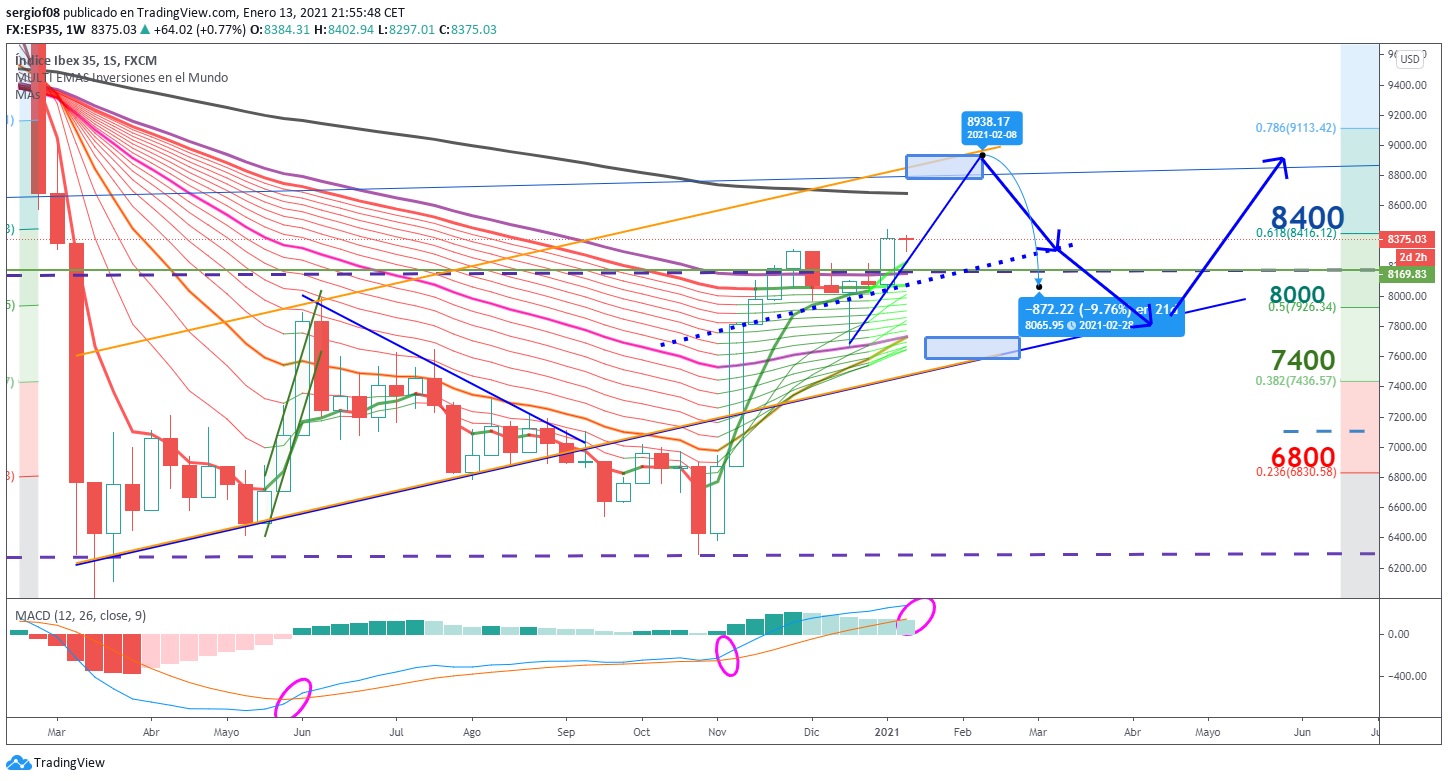

Then Trump would lose by an overwhelming majority, losing in almost 10 states, just the result with which he won 4 years ago, losing by more than 7 million votes. And Europe celebrated it, and so much, raising the Eurostox to pre-covid levels. With the focus on the change of relationships that will take place in the future. The euro has been climbing to 3-year highs and right now we are in a tough spot on this index. Having already reached the 61.8 fibonacci retracement as I show in the following image. What should we do? .

Right now the most prudent thing is not to buy more. Save liquidity and in many values hold for a possible rise, in others disappear and wait for it below. The values where it should be maintained are those that have hardly appreciated, some banks that could rise if the IBEX reaches 8,800. Which I see as feasible in the face of the last rally in the USA, since annual results will be presented in January 2020 and quarterly and everything presages further increases. Securities such as renewables are better to sell with capital gains and wait since the benefits of many years are discounted in some cases.

In case it reaches 8,800 I expect a downward trickle and some fat drop in a healthy correction of the markets that could take us to 8,000 points at the most and 7,600 as a key objective. That is why as soon as 7900 touches it would be a good time to start making small purchases again. The next goal, which is this year is 10,000, and finally finish the V in Spain than in the USA and Germany has already been done, and in spades . I see this objective rather in October of this year, but let's see it before.

© 2016 - All Rights Reserved - Diseñada por Sergio López Martínez