After the shareholders' meeting was not approved due to a very controversial cancellation. This annulment occurred on the grounds that the company was bankrupt and therefore in bankruptcy, and the shareholders could no longer hold meetings, electing a bankruptcy administrator, Ernest and Young , which were supposedly sold to the actor The main entity that controls this entire process, Banco Santander. The president of that time, Juan Pablo López Bravo and his advisers embarked on trying to rescue an American fund that had supposedly been hired by Banco Santander to dissolve the company and sell what had value, trying to leave 0 to the shareholders, those who placed their trust in the company years ago and who had the majority. Santander barely reaches 3% after its decision to sell its shares, which reached 21% well below the price it should have but well above the price that was quoted after its exit from the Spanish stock market, 0.0061 euros per share. Let us remember that Santander bank sold its shares for between 1.5 cents and 6 cents. These shares were granted after the first great dilution of the value, which went from 20 cents to 2 cents at its opening on the stock market. As compensation, 50% of the new shares were given under the tutelage of Sebastian Albella who left his post very opportunely after the suspension of Abengoa on the stock market in 2020.

And it is that in this scandal, one of the many by the way of the Spanish continuous market, there are many actors involved. Based on the offer of Terramar and the necessary non-quorum of the shareholders and after a complaint in summer for not calling a shareholders' meeting to present the 2019 results, something unusual in the Spanish stock market that has not happened with any value, it would be decided to convene an extraordinary meeting in September 2021.

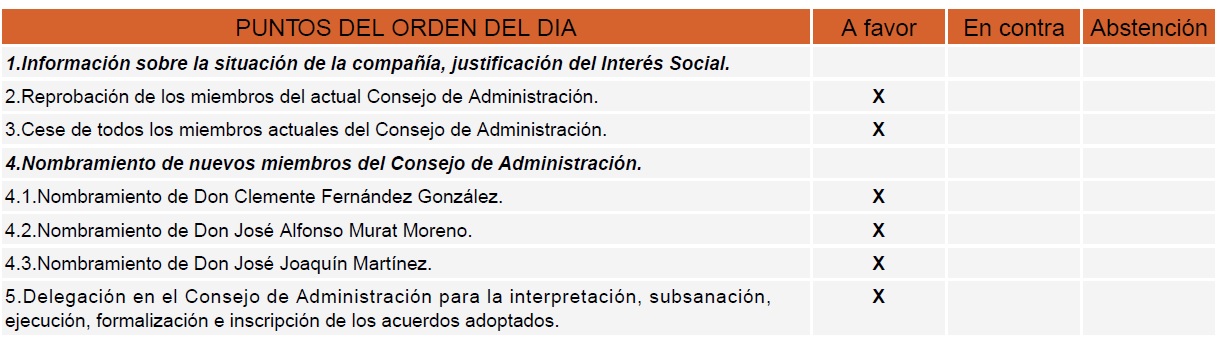

At this shareholders' meeting, Clemente Fernández was elected president with 23% of the vote and his partner Martínez Tieso, representative of the shareholders. After the meeting there would be a new one to remove the directors who had deliberately put to hinder the desire of the shareholders. Even so, there is still the bankruptcy administrator chosen by the old management.

After the end of the year the proposal made by Terramar, the American fund has expired, and a firm proposal is awaited by a Spanish company that provides a certain guarantee to the process since this company is strategic for Spain, dedicated to renewable energies, and desalination plants as well as water treatment . The SEPI, which is the Spanish fund for companies as affected as Abengoa, is waiting to grant enough aid to companies like Abengoa, such as Técnicas Reunidas .

In the air there is also a lawsuit against the ex-president of Abengoa González Urquijo and his directors , responsible for the situation in which he finds himself and who, after the failure they have carried out, were signed by other companies of the IBEX as Talgo for González Úrquijo. The failure in part since the Santander Bank that supposedly put it up has received a lot of money in the form of high interest on loans after the 2017 restructuring.

So, we hope that an agreement is reached between shareholders, creditors, bondholders, the state and the new partner who enters for the best possible for all those involved and that the workers recover normality already affected by the entire covid pandemic. They have just suffered the pandemic and the entire problem of their employment still unsolved, those who have endured because many have decided to leave. This year 2022 will be key for the company after two years of stoppage of new projects.

© 2016 - All Rights Reserved - Diseñada por Sergio López Martínez