First of all, admit that I was one of the many who did not take sufficient measures before the bustling catastrophe that came. Of course, once the SP500 fell to almost 2,000 points, I was one of the few who saw that point as a great opportunity.

While many analysts warned that the fall was little compared to the one to come, I already saw the opportunism of those same analysts who recommended buying not many weeks ago. At that time, the strategy had to have been a change of portfolios, forgetting all of the above, since the fundamental analyzes were no longer valid, a mistake made by many when buying or selling.

First of all, admit that I was one of the many who did not take sufficient measures before the bustling catastrophe that came. Of course, once the SP500 fell to almost 2,000 points, I was one of the few who saw that point as a great opportunity.

While many analysts warned that the fall was little compared to the one to come, I already saw the opportunism of those same analysts who recommended buying not many weeks ago. At that time, the strategy had to have been a change of portfolios, forgetting all of the above, since the fundamental analyzes were no longer valid, a mistake made by many when buying or selling.

Besides, there was a lot of opportunism in companies with little capitalization to sink the action and swap actions with buddies . Duro Felguera, Abengoa, Tubos Reunidos, small real estate firms and a large part of the continuum.

for

It depends on the cronyism, some would recover the first and others not even yet in 2021 have recovered half of the fall and in part this complete asymmetry is not due in most cases to the coronavirus itself but to manipulation by some few and the null action of the CNMV that throughout the year has not taken any action against any company. The only thing they did was to prohibit short positions for 2 months to satisfy some, although these positions were nothing more than the privileged information that some have to hedge on securities that they had previously thrown, in order to act more quickly in the event that an event occurs and they have to buy back. The Spanish market is a mafia that was sensed but this year it has been confirmed. The less you capitalize, the more manipulated the value is, moving it a few hands and playing with the few investors they have.

Besides, there was a lot of opportunism in companies with little capitalization to sink the action and swap actions with buddies . Duro Felguera, Abengoa, Tubos Reunidos, small real estate firms and a large part of the continuum.

for

It depends on the cronyism, some would recover the first and others not even yet in 2021 have recovered half of the fall and in part this complete asymmetry is not due in most cases to the coronavirus itself but to manipulation by some few and the null action of the CNMV that throughout the year has not taken any action against any company. The only thing they did was to prohibit short positions for 2 months to satisfy some, although these positions were nothing more than the privileged information that some have to hedge on securities that they had previously thrown, in order to act more quickly in the event that an event occurs and they have to buy back. The Spanish market is a mafia that was sensed but this year it has been confirmed. The less you capitalize, the more manipulated the value is, moving it a few hands and playing with the few investors they have.

Many analysts a month after covid19 discarded the V and said that the recovery would take a long time. A terrible mistake that serves to stop reading certain newspapers. And the thing is that the economy and the stock market are related but they do not go hand in hand, the market is far ahead of events and the always hope of the arrival of something can cause tremendous movements. This I already knew, and in fact the clearest example was in the oil crisis of 2016 in which the price fell to a minimum due to the overproduction of Arabia. China took advantage of the situation to fill its deposits, filling large supertankers that gave it the consumption of a couple of years at a ridiculous price, below $ 30 a barrel. It would not take two months to recover half of the fall and it is precisely what has happened now and what will continue to happen.

The US indices in their big rebound took away the majority of retailers who short bet on a past bull, and they ate all the fall. Some say that it was the FED that bought the stock or bonds, others that it was the same companies that sold that bought back. What is true is that the greats when they make change in trend movements do so against the market and when the majority do not expect it, so given the prices that were there it was not very difficult to have positioned long and wait. There are analysts who always want to win the last drop and by waiting many times they are left out and that is what has happened. Let's hope they reconsider for the next great crisis that may take 5 years or 20 years.

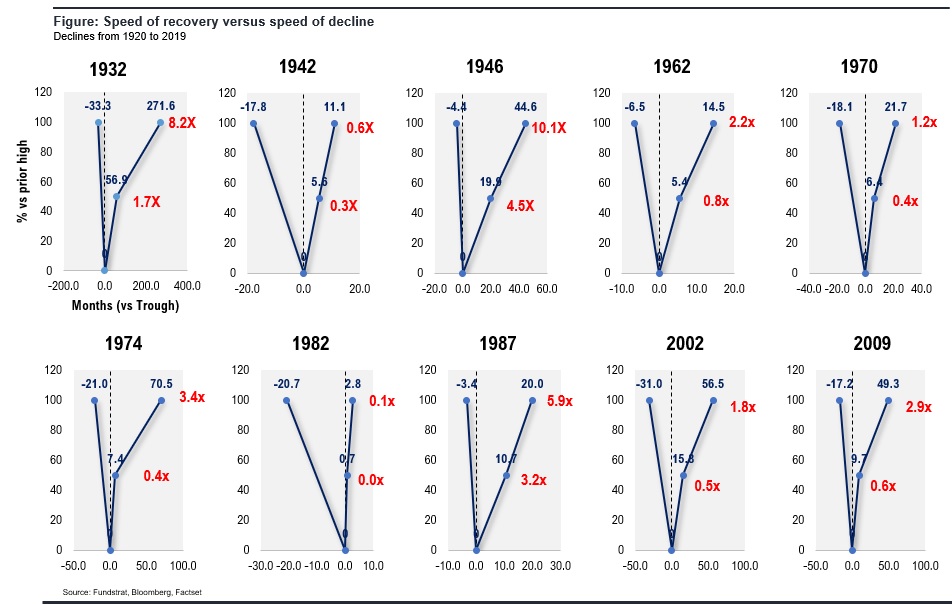

The following image shows how the stock market and the economy have recovered in different crises in the history of the 20th century. In this case, the fall has been as abrupt as possible since an index had not fallen so much in a couple of weeks. That is why when it happened and knowing that everything was fear of something that was not known, it could be reversed very quickly. In the end it was not so fast but in less than 6 months indices such as the NASDAQ or the SP500 were already recovered. NASDAQ at record highs. The other major indices like the German DAX or the DOW JONES would take a little longer. Many say that the recovery will be in K since there are values that will not be recovered but my opinion is that it will be in a longer V in some and in others it will get unimagined levels since a lot of money has been injected into the system to stimulate purchases and activity. It is like a V but because you put a factor that in theory should generate inflation soon, so it is not really that all sectors are benefited, but rather that some will be behind the system. The mistake right now is to leave your money static since in no less than 5 years it will have lost a lot of value compared to other securities, including safe havens such as gold that have started their upward cycle again.

The clear strategy was to focus on technology and pharmaceuticals or health sector stocks and get rid of banks or cyclical stocks such as energy. Very few hit the nail on the head that in the face of confinement in most countries these companies were going to be the lode. Not even renewables were the option at first. While they have been recovering since the beginning of the pandemic. for It was difficult to read that values in Spain such as Pharmamar were going to multiply their buffer value by more than 10 . When they had already risen three times in value, few dared to continue or to enter the value. Although it is normal that it has fallen 50% from highs and still falling 25% more, we would be facing a spectacular rise. No matter how much coronavirus there is a value, it cannot be multiplied by 10 in 1 year. That rise is not sustainable and if it is, it is because it was very devalued at the beginning of the rise. Now that the coronavirus is coming to an end, it is logical to think that these companies are losing their attractiveness in favor of other types of companies.

After the US elections there has been a sudden change. The rally of the NASDAQ of technological values and in general of the entire United States towards the most affected countries such as Spain has stopped. And it is expected that the tensions between Europe and the United States begin to loosen with Biden as president. The dollar has fallen again and the euro is already at highs not seen in three years.

for

Many analysts did not expect the strong rise that the IBEX hit in November after a downward pressure not seen until then. There were securities that were trading at historic lows with a capitalization well below their book value. Although the book value of banks is falsified since most assets are not worth a quarter of what they say they are worth. Today everything derived from loans or the real estate sector is worth a quarter at current market prices.

for

Securities such as Santander, Repsol, BBVA are the ones that have brought the greatest recovery from lows, having already exceeded 61.8% fibonacci and it is expected that in 1 year they will double their value, with the objective of 3, 10 and 5 euros respectively .

After the US elections there has been a sudden change. The rally of the NASDAQ of technological values and in general of the entire United States towards the most affected countries such as Spain has stopped. And it is expected that the tensions between Europe and the United States begin to loosen with Biden as president. The dollar has fallen again and the euro is already at highs not seen in three years.

for

Many analysts did not expect the strong rise that the IBEX hit in November after a downward pressure not seen until then. There were securities that were trading at historic lows with a capitalization well below their book value. Although the book value of banks is falsified since most assets are not worth a quarter of what they say they are worth. Today everything derived from loans or the real estate sector is worth a quarter at current market prices.

for

Securities such as Santander, Repsol, BBVA are the ones that have brought the greatest recovery from lows, having already exceeded 61.8% fibonacci and it is expected that in 1 year they will double their value, with the objective of 3, 10 and 5 euros respectively .

After the increases in values such as SIEMENS GAMESA or Solaria that trade with a very high PER and that not in 10 years will they achieve that value with the benefits that are expected, we must opt for values that have not yet discounted the end of the pandemic since these values before any general decrease will correct a lot.

In Spain these values such as SOLTEC, SOLARPACK, GRENOBLY RENOVABLES have hit an exponential rise that does not adjust to its value at all, that is why if you are within, have an adjusted stop. AUDAX RENOVABLES is close to targets, 2.44. For what happens exactly the same as the previous ones. Investing in renewables right now is not good, the big funds and banks did it in November and they would soon be starting to reap benefits.

It is one of the star sectors of the moment. Never in history have they traded at such a low value. It is estimated that interest rates will not rise for 10 years, but nobody knows anything for sure. Any change could cause these types of assets to skyrocket and the arrival of inflation could be the signal for the purchase gun in this sector. The value of inflation is known month by month, but the real value is somewhat more complex since it is necessary to discount price increases such as electricity and oil to have a better vision. That is why being bought at these prices is a very good option.

This sector has almost recovered as well and was one of the first to get up from the hack of March and April, being ACS the best example of this. Securities such as ACS, Ferrovial or Sacyr are already little to recover all the fall. These are values that can still go up higher and should recover their precovid value as the crisis lessens.

It is one of the most defensive sectors in the face of any catastrophe, right now some securities are trading at a discount but they have already recovered almost everything they lost to last year's lows. It is good to have a small percentage in this type of assets in a situation in which the crisis has not yet been fully emerged and in which there are doubts that the coronavirus will last longer than expected. If the situation improved and most of the sectors were tight, a lot could be put into this bag. Faced with a regular situation of the economy. Now is not the time.

It is one of the sectors most affected by recessions of this type. Lower demand causes prices to fall and companies must sell just enough. Right now many companies are trading at a knockdown price with asset values well above their stock market valuation, but these assets are audited at a very high value and could be sold at half price if necessary. Especially companies with a large debt. Better to be on the sidelines and keep waiting, or be stuck with a small portfolio value. It is the extreme opposite to the ENERGY sector.

© 2016 - All Rights Reserved - Diseñada por Sergio López Martínez