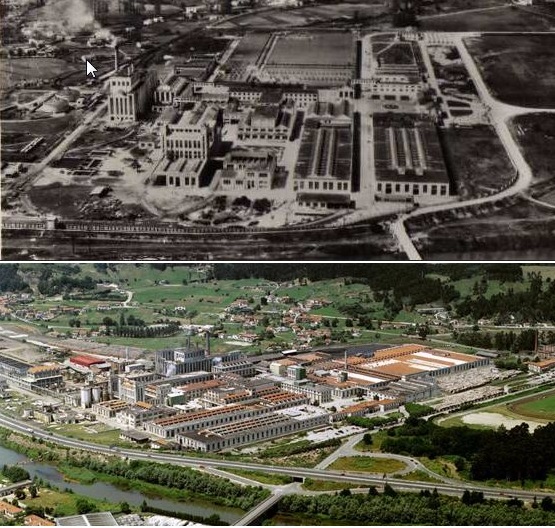

Sniace, S.A. was established on December 1, 1939 with registered office in Madrid, its industrial facilities and administrative offices in Torrelavega (Cantabria) and a sales office in Barcelona.

The viscose factory begins its production in 1946 while the pulp mill would do so in 1950. Both are expanded to their current capacities in 1983 and 1984 respectively. The group's thermal power plant was commissioned in 1985. In 1986 it reached an agreement with the Norwegian group Borregaard to set up the Lignotech Ibérica company, specialized in the sale of lignosulfanatos for different applications and sectors. In May 1989, the company Bosques de Cantabria (BOSCAN) was set up to provide services to the Sniace forest estate, including reforestation, conservation, improvement, utilization, fire prevention and firefighting. .

The viscose factory begins its production in 1946 while the pulp mill would do so in 1950. Both are expanded to their current capacities in 1983 and 1984 respectively. The group's thermal power plant was commissioned in 1985. In 1986 it reached an agreement with the Norwegian group Borregaard to set up the Lignotech Ibérica company, specialized in the sale of lignosulfanatos for different applications and sectors. In May 1989, the company Bosques de Cantabria (BOSCAN) was set up to provide services to the Sniace forest estate, including reforestation, conservation, improvement, utilization, fire prevention and firefighting. .

The Sniace Group began a diversification activity towards the renewable energy sector in 1999. Its two main objectives are the construction of a cogeneration plant that allows reducing both the energy costs of the industrial complex and the use of coal as a source thermal, and the development of a bioethanol production project in its factory premises in Torrelavega. In 2001, the construction of a 80 MWh co-generation plant was completed. Plant that would increase the installed capacity of the group to 100 MWh and allow it to sell the surplus energy to the grid.

In 2013, due to the high debt and the low expectations of the group, an ERE was carried out in order to reduce their expenses. This was not the first major crisis since in 1983 they wanted to make an ERE even more numerous that affected 800 workers and in the end it was not executed and the factory did not close. The debt at that time was 560 million pesetas, about 6 million euros currently. And this time the group's debt reached 10 times the size of the company, about 150 million euros .

After 5 years closed the plant would reopen in 2017 with 360 workers. Before opening it, it would start trading back to the stock market and generate a lot of expectation. The media would echo and create a bubble that left many small investors caught. When opening it would do it at € 0.025. An excessive price for a company that had not opened and that had many questions. It would soon drop to € 0.07, in part because of the sales of the company's own shareholders. In May of the following year I would return to reach those maximum values with which I start but it would not be more than a mirage since all this would be an operation to leave even smaller investors caught. And it is quickly announced a capital increase, as early as April 2016.

The main architect of these operations would be President Blas Mezquita , a person who was in charge before the reopening and who was one of those responsible for the closure. Already at this point any investor who was inside should have foreseen any type of maneuver and is that the aforementioned Mosque did not stop talking in the media of the smooth running of Sniace and that soon it would reach to reach 70 cents of euro per share and a capitalization close to 100 million but did not talk about the bad results of the group, with an ascending debt and the main factory still not opened due to the works .

All this operation was just to open the plant with the money of shareholders. Once opened, the results would not go as expected and a new capital increase would be carried out. In October 2016, new highs close to € 0.035 would be reached, € 0.026 at the current rate and down to half the value. All this without apparent news that reflects the changes being a value that can not be followed or predict their behavior. In addition, the group did not usually give information when it was convenient and the quotation stagnated, being completely opaque the communication with the shareholders through the company and also through the CNMV. Only mandatory results would be presented every four months

In 2018 a new expansion would take place and would leave the reputation of the company in tatters since in 2017 all the capital that had been increased should go to put into operation what was supposed to be the flagship of the company. A modern viscose plant that was going to generate some 35,000 tons of lignite per year and increase the cellulose production of the other plant by more than 40% . All this would not work as they had expected since the group gave a lot of losses. This would favor that after the presentation of results with a certain improvement after the walking of the plant, a decrease of the value of the titles of the company equivalent to 50%. The flight of investors would be large and many of the first investors who had gone to the two previous extensions would be trapped. Many of them would not go to the expansion that would be double the capitalization, the maximum punishment allowed by the CNMV. If it exceeds that figure it is a dilution and its call must be of an exceptional nature.

So the two main shareholders of the company would have no choice but to subscribe to all the rights and many of other shareholders, going on to have a big hole in their accounts.

The new share would have a price of € 0.10 rights, that is € 0.11 in total. Making an additional decrease of another 50% (€ 0.024 - € 0.014 - € 0.011). This neutral value is not more than the previous value of capitalization of the company that is around 70 million euros. Therefore it is clear that year after year the company has been losing 35 million. All the new capital that was received by the investors in salaries and other necessities was crushed. As if it were not enough, the action after the expansion far from rising would begin a decline without explanation on the part of the company that would take the titles to € 0.07 in October and December 2018.

In 2019 it would happen what would have been logical long before, the resignation of the president of Sniace . In this case for the possible imputation in crimes against the environment a decade ago. The cause seems ridiculous since the most logical thing would have been to resign because of the bad management and not make other excuses. The most impressive were the president's salary increases and the bonuses he received year after year, all on behalf of the shareholder. So the company would present 2018 annual results quite negative in February of this 2019, but quite far from what was expected (about 15 million losses). And with a new address, they would have taken a possible loan from banks and entities, since a new extension would not be viable given the refusal of the two main shareholders, Felix Revuelta and Sabino Garcia . And it is that a new extension would not be subscribed by almost any shareholder who already have some losses that exceed 70% of average of the contributed thing.

In 2019 it would happen what would have been logical long before, the resignation of the president of Sniace . In this case for the possible imputation in crimes against the environment a decade ago. The cause seems ridiculous since the most logical thing would have been to resign because of the bad management and not make other excuses. The most impressive were the president's salary increases and the bonuses he received year after year, all on behalf of the shareholder. So the company would present 2018 annual results quite negative in February of this 2019, but quite far from what was expected (about 15 million losses). And with a new address, they would have taken a possible loan from banks and entities, since a new extension would not be viable given the refusal of the two main shareholders, Felix Revuelta and Sabino Garcia . And it is that a new extension would not be subscribed by almost any shareholder who already have some losses that exceed 70% of average of the contributed thing.

So the action goes without a clear course with a lower capitalization than in previous years. This does not make sense since now is when the company is really starting to work and begins to show signs that it could already yield a positive EBITDA. The fact responds more to the punishment of investors and funds to the lack of information of the company and the successive deceptions by the previous address .

| ### | 2015 | 2016 | 2017 | 2018 | 2019 |

|---|---|---|---|---|---|

| Debt/ Cash company | Total Debt (M) | - | 60,1 | 61,2 | 49 | - |

| Benefit/Share value | |||||

| Capitalization(M) | 14,8 | 14,8 | 14,8 | 38,3 | 60,4 |

| EBDITA (M) | - | 0,42 | 0,46 | 3.184 | - |

| Net Profit (M) | - | - | 17 | -58 | - |

From the fundamentals table we observe how the negative EBIDTA and negative net benefits year after year is the most dissonant note of the company . After opening is true that the first year and the second can be attributed to the set-up of the company but it has been 3 years since the activity began and many millions have been injected through capital increases to keep things the same. The only positive data is given by the increase in income that has been quite large . Although not necessarily positive because despite the large increase in income we find that it does not translate into profit then the profitability of the work done in the company begins to be questionable. Due to the opacity of the company and the change of address it would be prudent to let at least two years pass to see the new evolution of the company and make decisions if we have shares or invest in this company if we have never done it .

If we look at the graph we see how the price since the reopening has only fallen. At the beginning it had several typical ups and downs of a value with so little capitalization in which few movements can cause the action to fluctuate a lot but then they have already taken shape. In these 4 years there have been 3 capital increases that have seriously damaged confidence in the action . Each enlargement has cost the action to be devalued by at least 40% as can be seen in the purple ellipses of the image. In 2 months after the enlargement the stock has been falling producing a distribution from 1 month before these announcements. Inside information that a few have obtained to go up little by little and distribute in the last weeks before formalizing the announcement . In 2017, after the dilution of half of the capital of the company in the form of new shares, there has been no return and it has not risen from the minimum cost of the new share (€ 0.11). Right now the situation of the company is very delicate because it must convert the current income into profits and debt reduction if you do not want to see the ghost of a bankruptcy. No one is going to save the company, neither shareholders nor banks, so the strategy of this value is clear.

The value is now triangulating between € 0.083 and € 0.10 . According to the graph at the end of April there should be either a fall or an increase to the edge of € 0.10. But this value does not take a reliable technician so any prediction is in vain.

Strategy: Keep actions trying to reduce positions in times of big ups or rebounds and wait for events.

© 2016 - All Rights Reserved - Diseñada por Sergio López Martínez