Telefonica until the year 2000 has more or less had the monopoly of telecommunications in Spain and has become a giant in South America. This substantial increase in activity has not been able to accommodate itself and there has been a decade since 2004 approximately until 2014 where things have been done very badly, as the sector has been completely liberalized in Spain. He has accumulated a monster debt that is now quite difficult to lose.

To reduce it urgently it has been tried to sell those businesses where it was not getting enough performance or were somewhat overvalued. An example is O2 in the United Kingdom where liberalization is total and Telefónica can not face local rivals or new companies in mobile rates such as GiffGaff or Free. Also it has for sale the philippine Telxius, which will be sold very briefly. A part of it has already been sold to Amancio Ortega, president of Inditex.

And is that Telefonica has to start hurrying to pay the debt selling everything you can and do not need because the rate hike by the ECB is just around the corner. Possibly in March of 2019 it will be announced by the end of the year, or beginning of 2020.

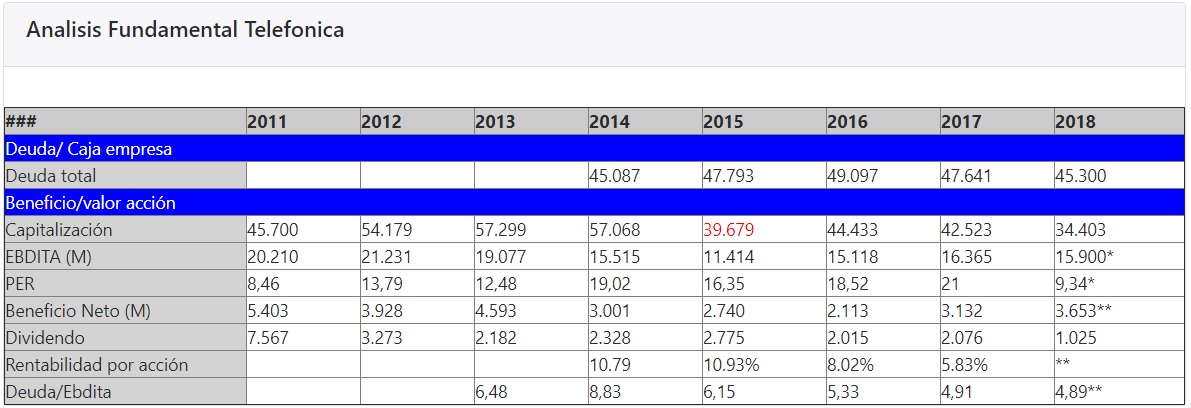

Here I present the data of fundamentals that I think are most important:

| ### | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|---|---|---|

| Debt/ Cash company | Total Debt | 45.087 | 47.793 | 49.097 | 47.641 | 45.300 | ||

| Beneficio/valor acción | ||||||||

| Capitalization (M) | 45.700 | 54.179 | 57.299 | 57.068 | 39.679 | 44.433 | 42.523 | 34.403 |

| EBDITA (M) | 20.210 | 21.231 | 19.077 | 15.515 | 11.414 | 15.118 | 16.365 | 15.900* |

| PER | 8,46 | 13,79 | 12,48 | 19,02 | 16,35 | 18,52 | 21 | 9,34* |

| Net Benefit (M) | 5.403 | 3.928 | 4.593 | 3.001 | 2.740 | 2.113 | 3.132 | 3.653** |

| Dividend | 7.567 | 3.273 | 2.182 | 2.328 | 2.775 | 2.015 | 2.076 | 1.025 |

| Profitability per share | 10.79 | 10.93% | 8.02% | 5.83% | ** | |||

| Debt/EBDITA | 6,48 | 8,83 | 6,15 | 5,33 | 4,91 | 4,89** | ||

If we look at the table we will see how the debt is enormous, around 50,000 million euros, almost what is capitalizing. Although it has a fairly large liability and assets with which it could be minimized as long as the net profit increased in a fairly large way. In addition it is seen as the benefit has been reduced and since 2016 has begun to rise again.

This rise of around 33% is very good news for Telefonica that if this change of direction has not occurred with the current president, the company could be very close to bankruptcy in the medium term. However, there are still hard years and battles to survive to reduce debt to a good level, such as 20,000 million , half of its current capitalization. This is because, due to the rise in rates, the debt may rise up to 5% each year as soon as they start to raise them.

Even as I said before, it has numerous assets between real estate and telecommunication centers that are highly valued so that it would never go directly to a creditors' meeting.

At the current prices of 6.5 of PER it is very interesting to position oneself in the value to expect a rebound in the short term and certainly in the medium term it will rise.

In the long term, seeing the inconveniences that it has with its debt and with the good fiscal policy of its rivals and the very competitive prices of small companies like Yoigo, Pepephone I see quite complicated that can be kept here in Spain without state aid

Firstly, I will show a long-term chart where the downtrend in value is perfectly visible, however, because this company pays fairly good dividends, the curve would not be as pronounced. This dividend policy that rewards the shareholder is not very effective since in the long term the shares have been falling a lot and the capitalization also with what there have been years in which the losses have far exceeded the yield of dividends that had accumulated.

As I said earlier these prices are good but could still get lower but it would be a little tightening the rope, because right now is when it is doing well enough, doing it less badly because seeing the trajectory might be that the claim.

The strategy would be to buy now and sell once you get close to 8 euros earning about 20% of profits (from 6.5 to 8). The next resistance could take a long time to reach, so to propose is to make sure. The risk equation in that strip is pretty attractive right now.

© 2016 - All Rights Reserved - Diseñada por Sergio López Martínez