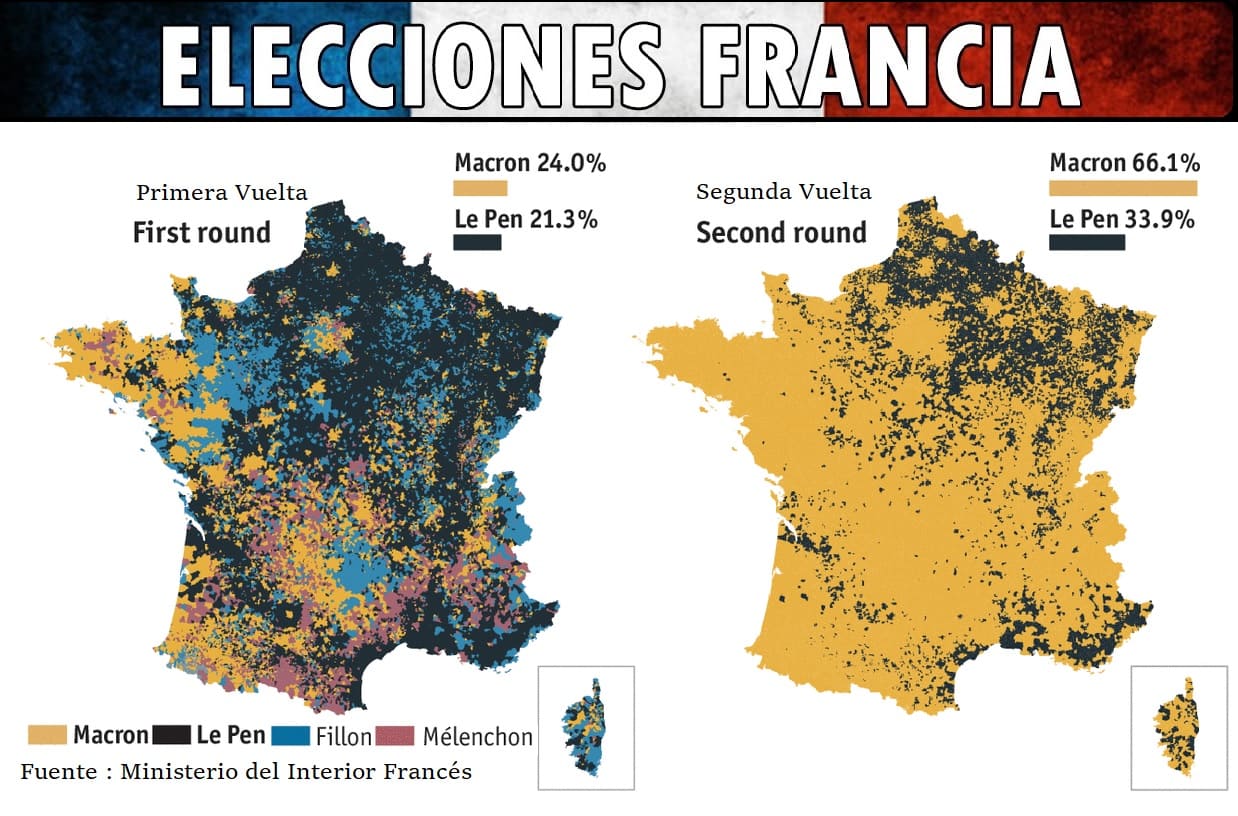

In the previous graph the final result is shown with a great victory of Macron, where the major fiefs were those of the French Socialist Party and the big cities. And those of Le Pen the deepest France, villages, the east and the north of France. You can also see the transfer of votes from the other parties to Macron, especially in the places where Fillon had won.

And finally it was the French elections. In this case they have faced Jean Marie Le Pen for the National Front and Emmanuel Macron for the new liberal party On Marche . Macron with ideas liberal economics and quite progressive in the social , has managed to agglutinate the vote of the whole center and the left. What is really at stake in these elections is the center-right vote, and on the part of the right, as well as the vote of the extreme left that could opt for Le Pen as their nationalist ideas come together in the most disadvantaged class.

In the previous graph the final result is shown with a great victory of Macron, where the major fiefs were those of the French Socialist Party and the big cities. And those of Le Pen the deepest France, villages, the east and the north of France. You can also see the transfer of votes from the other parties to Macron, especially in the places where Fillon had won.

And finally it was the French elections. In this case they have faced Jean Marie Le Pen for the National Front and Emmanuel Macron for the new liberal party On Marche . Macron with ideas liberal economics and quite progressive in the social , has managed to agglutinate the vote of the whole center and the left. What is really at stake in these elections is the center-right vote, and on the part of the right, as well as the vote of the extreme left that could opt for Le Pen as their nationalist ideas come together in the most disadvantaged class.

Remember that in the first round against the forecast the two hegemonic parties of France were left out, both the traditional right, the UMP and the French Socialist Party, PSF. In this way, On Marche remains on the one hand, a liberal party that is very fond of markets, of a pro-European and pro-globalization and on the other hand a populist party, the National Front, FN, very close to the protectionist and immigration ideas of the United States and the United Kingdom . Due to the radical cut that the FN has, the polls quickly gave a clear advantage to Macron's party, even though it was quite new and less known, although it had already been in the French socialist party as minister.

Clear the first round that was the one that more doubts had the markets did not wait and the European stock exchanges would rise with force. In addition also it was noticed in the European currency with big rises in front of the rest of currencies. The IBEX35 would reach 11,200 points at its maximum and the DAX30 would reach 13,000 points.

In the following graph I show the impact of the first victory of Macron on the indexes.

After the results of the second round and after discounting this victory in advance, all the values would correct with force and that is that the stock exchange usually advances situations and even overvalues them. The graph shows the total route from the December 2016 minimum of DAX30 (in orange) is 20% while the IBEX35 (in blue) was 30% , reaching 11300 points. This is due to the overcasting of the IBEX last year and the improvement of the forecasts of the Spanish economy with ratios that reach 3.2% growth.

Between the first round and the second round, there was just a 33% increase in the two indexes, so it is clear that Le Pen's defeat was not entirely discounted. After the rises the correction is greater in the IBEX.

Next I show the long-term chart where it is seen that the DAX30 reached maxima not seen in more than 10 years while the IBEX revalidated almost the values of 2015 where it reached more than 12000 points. And is that the DAX30 was very touched with the 2008 crisis while the IBEX bounced quickly. Being the crisis of the policy and the bank rescue of 2012 when it was most noticeable in the selective Spanish. With this the IBEX35 still does not break its bottom line, although the IBEX against the DAX has a large percentage of lost points due to dividends with which its real value should be slightly higher, around 2% per year.

© 2016 - All Rights Reserved - Diseñada por Sergio López Martínez